CSG SYSTEMS INTERNATIONAL (CSGS)·Q4 2025 Earnings Summary

CSG Systems Q4 2025 Earnings: Beat on Both Lines, Stock Stable Ahead of NEC Merger

February 4, 2026 · by Fintool AI Agent

CSG Systems reported Q4 2025 results that meaningfully exceeded expectations, with non-GAAP EPS of $1.53 beating consensus by 37% and revenue of $323.1M topping estimates by 16% . However, the stock remained flat at ~$79.45, trading tightly around the NEC merger consideration as shareholders await the deal's closing, expected by year-end 2026 .

GAAP earnings were impacted by $10.5M in merger transaction costs and accelerated stock vesting, resulting in GAAP EPS of just $0.25 vs $1.21 a year ago . On an adjusted basis, the company delivered strong operating leverage with non-GAAP margins expanding 220 basis points to 22.3% .

Did CSG Systems Beat Earnings?

Yes — CSG beat on both revenue and EPS.

*Consensus estimates from S&P Global

The revenue beat came from continued growth in CSG's SaaS and related solutions . The EPS beat was driven by strong operating leverage, with cost efficiency actions taken during 2024 and 2025 flowing through to margins .

Beat/miss streak: CSG has now beaten EPS estimates in 8 consecutive quarters, though revenue results have been more mixed.*

What Changed From Last Quarter?

Key sequential changes from Q3 2025 to Q4 2025:

*From S&P Global estimates data

What's different:

- Seasonally stronger Q4 — Q4 is typically the strongest quarter for CSG

- Merger costs intensifying — Transaction-related costs increased to $10.5M in Q4 vs minimal amounts in prior quarters

- Accelerated vesting — Stock-based compensation jumped to $19.8M in Q4 from $8.6M a year ago due to accelerated vesting tied to the merger

What Is the NEC Merger Status?

CSG entered into a merger agreement with NEC Corporation on October 29, 2025 . Key milestones:

The stock trades tightly around $79.45, reflecting the deal consideration. Remaining conditions include customary regulatory approvals .

Full Year 2025 Performance

The GAAP earnings decline was entirely due to merger-related costs ($13.7M transaction costs, $46M stock compensation) and a higher effective tax rate . On a non-GAAP basis, the company delivered solid 9% EPS growth and nearly 30% free cash flow growth.

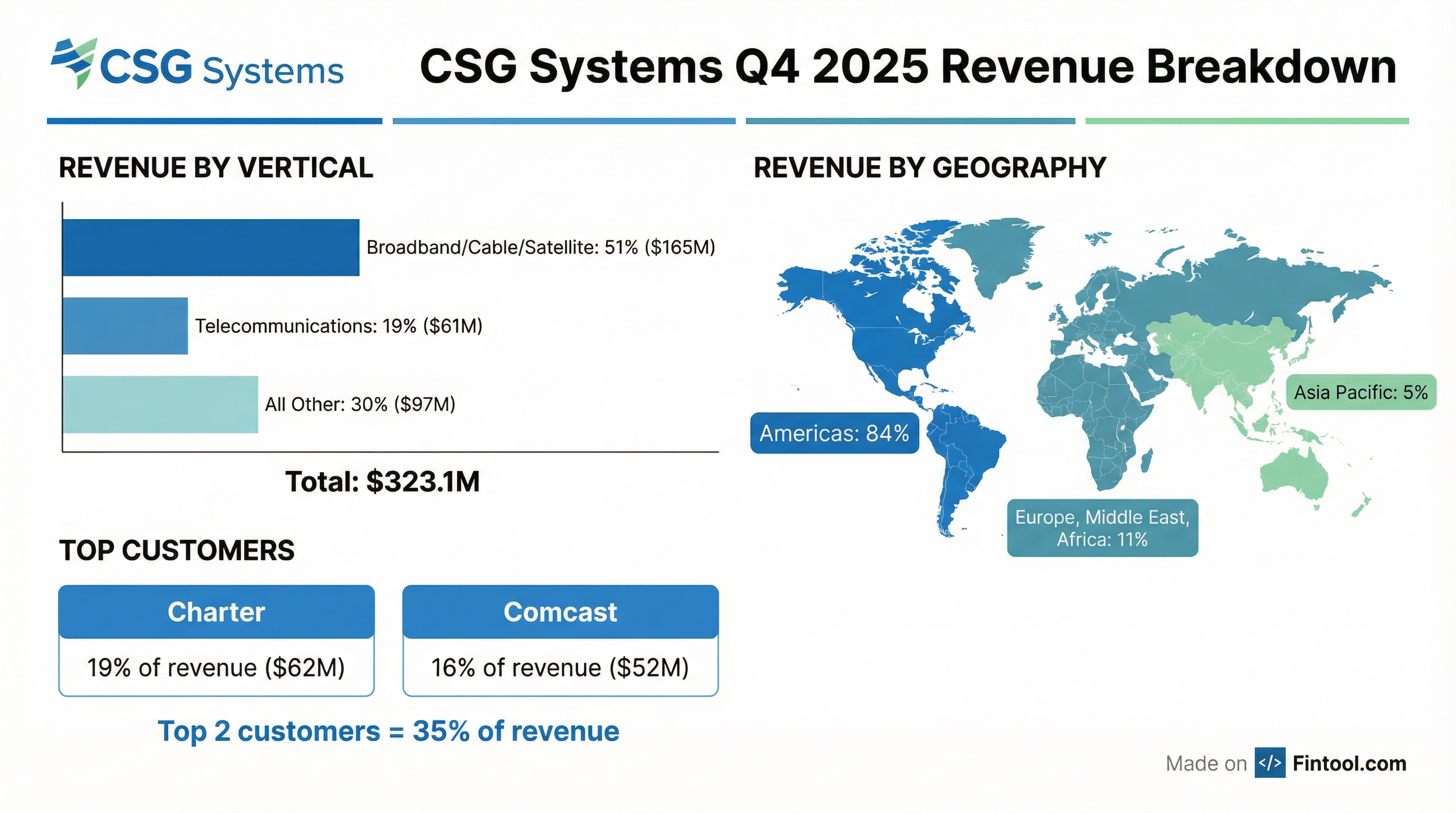

Revenue Breakdown by Segment

By Vertical (Q4 2025):

- Broadband/Cable/Satellite: 51% of revenue

- Telecommunications: 19%

- All Other: 30%

By Geography (Q4 2025):

- Americas: 84%

- Europe, Middle East & Africa: 11%

- Asia Pacific: 5%

Customer Concentration:

- Charter: $61.8M (19% of Q4 revenue)

- Comcast: $52.2M (16% of Q4 revenue)

Top 2 customers represent 35% of revenue — concentration risk remains a consideration, though both are long-standing relationships.

Shareholder Returns

Despite the pending merger, CSG continued its capital return program:

Dividends:

- Q4 2025 dividend: $0.32/share (~$9M)

- FY 2025 total dividends: ~$37M

- January 2026: 6% dividend increase to $0.34/share

Share Repurchases:

- Q4 2025: 332K shares for $25M

- FY 2025: 1.26M shares for $83M

Balance Sheet Highlights

Net debt improved slightly as cash generation outpaced the prior year. The company maintains adequate liquidity heading into the merger close.

How Did the Stock React?

Stock essentially flat — trading at $79.45, down -0.4% on the day.

This muted reaction is expected given the pending NEC merger. The stock has traded in a tight range since the October 2025 announcement, effectively pricing in the deal consideration rather than quarterly operating results.

The stock is up ~45% from its 52-week low, primarily driven by the merger premium.

What to Watch

-

Merger closing timeline — Expected by end of 2026, subject to remaining regulatory approvals

-

Deal risks — The 8-K outlines extensive risk factors including potential competing proposals, transaction costs, and integration challenges

-

Operating performance through close — With the deal pending, management may face distractions; watch for any deterioration in execution or customer relationships

Key Takeaways

- Strong beat — Non-GAAP EPS beat by 37%, revenue beat by 16%, driven by SaaS growth and margin expansion

- GAAP noise — GAAP EPS of $0.25 was impacted by $10.5M merger costs and $19.8M accelerated stock compensation

- Merger on track — Shareholders approved Jan 30; closing expected by end of 2026

- Stock stable — Trading at ~$79.45, near the implied deal value, with minimal reaction to earnings

- Full year solid — FY25 non-GAAP EPS +9%, free cash flow +29%, with 220bps margin expansion

Data sources: CSG Systems 8-K filed February 4, 2026; S&P Global consensus estimates